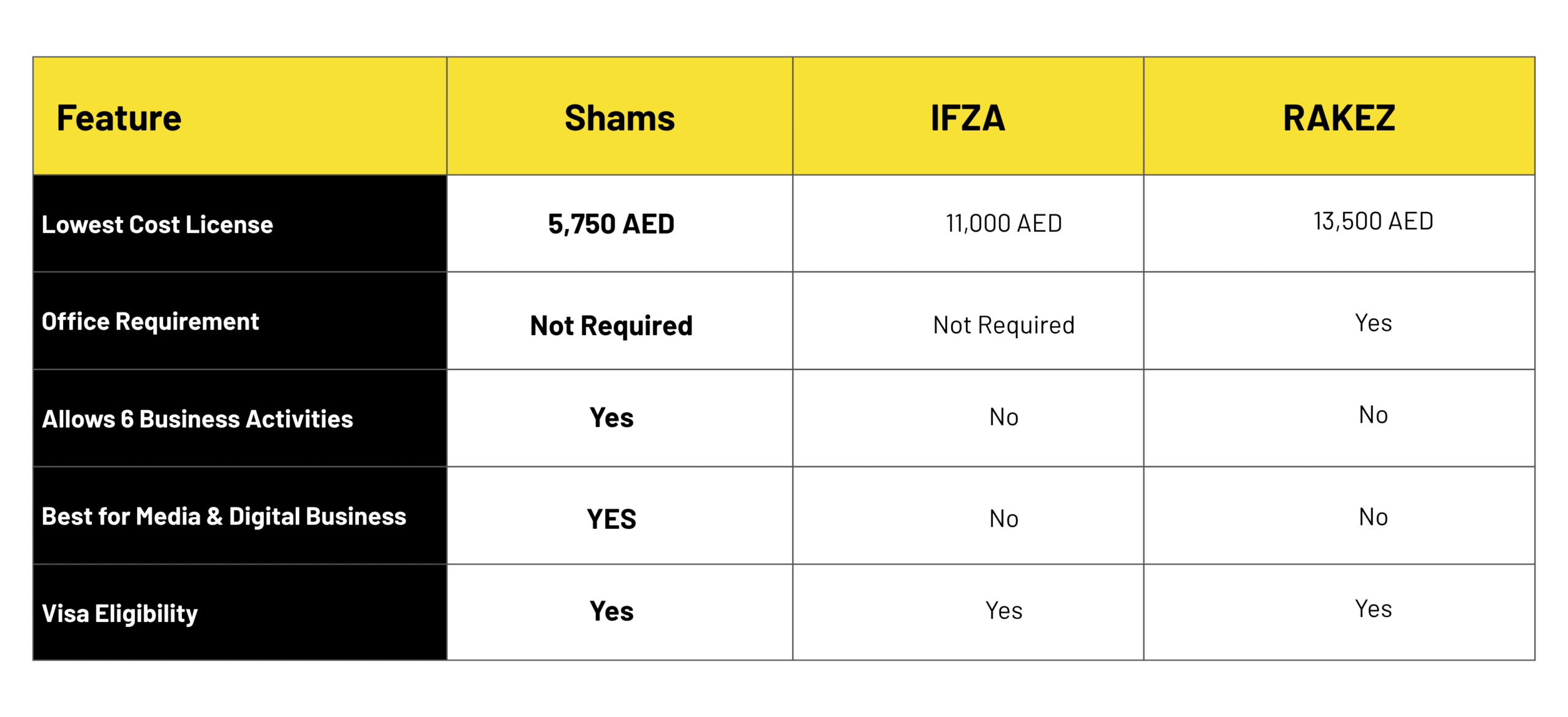

1-year license, 1 visa

1-year license, 1 visa

1-year license, 2 visas

1-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

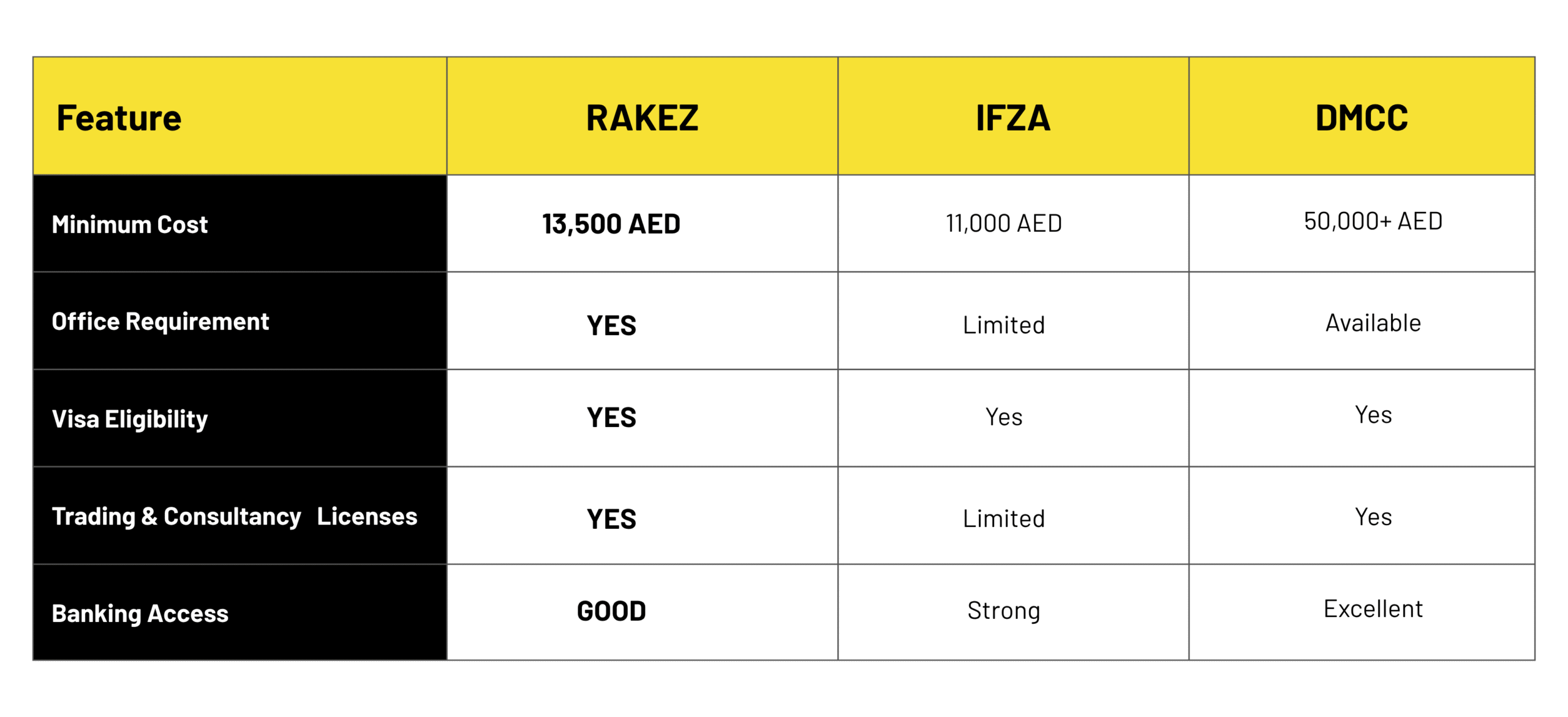

1-year license, No visa

1-year license, 1 visa

1-year license, 1 visa

3-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

Choosing the right free zone depends on your industry, business model, and expansion plans. Contact us for a personalized consultation.

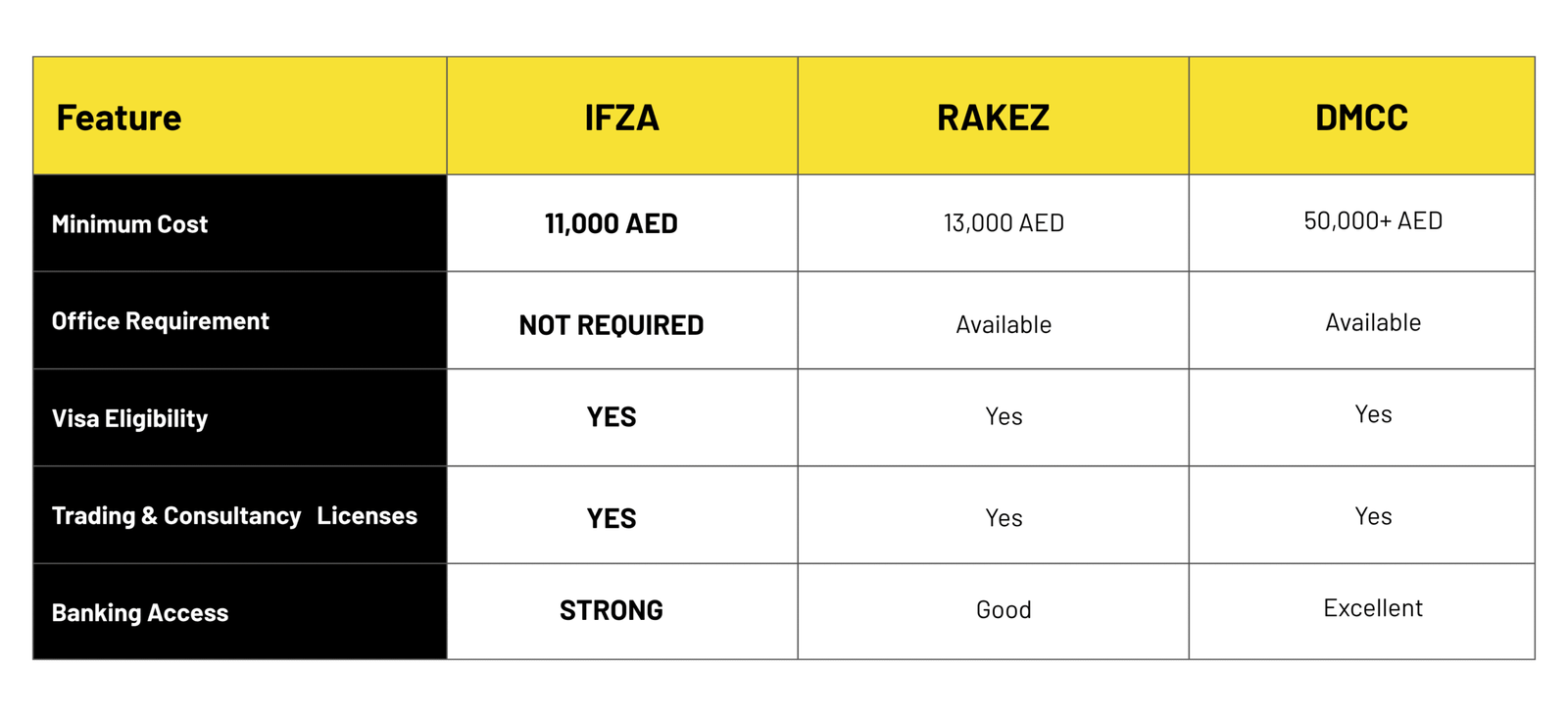

1-year license, No visa

1-year license, 1 visa

1-year license, 1 visa

3-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

Choosing the right free zone depends on your industry, business model, and expansion plans. Contact us for a personalized consultation.

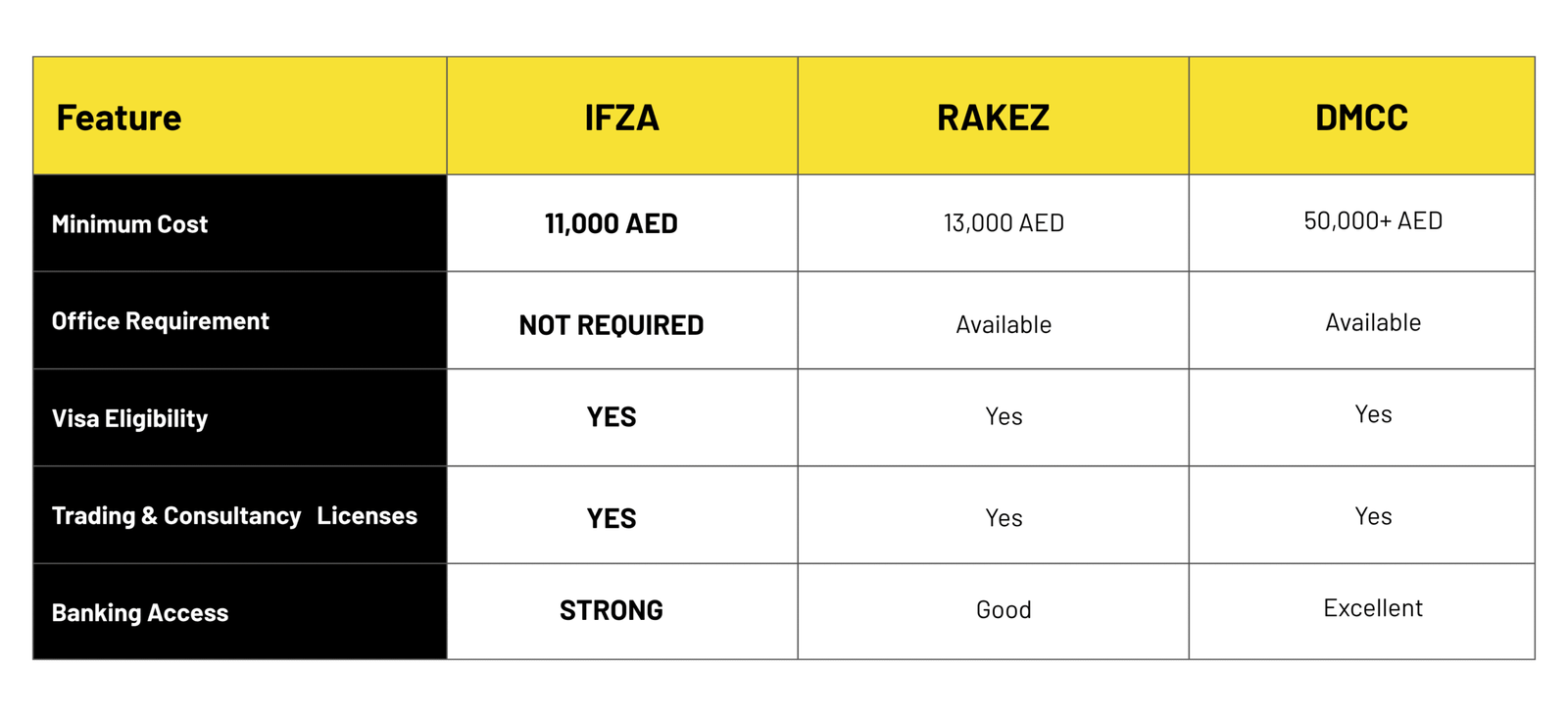

1-year license, No visa

1-year license, 1 visa

1-year license, 1 visa

3-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

1-year license, No visa

1-year license, 1 visa

1-year license, 1 visa

3-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

1-year license, No visa

1-year license, 1 visa

1-year license, 1 visa

3-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

Wyoming is one of the most attractive states in the United States for entrepreneurs, startups, and international investors. Known for its pro-business policies, strong asset protection laws, and straightforward compliance, Wyoming has earned a reputation as a jurisdiction where businesses can thrive with minimal complexity. Unlike other U.S. states, Wyoming imposes no state corporate or personal income tax, making it one of the most cost-effective choices for incorporation.

For foreign investors, Wyoming offers credibility as part of the U.S. legal system while also ensuring flexibility, privacy, and protection. Whether you are seeking to expand into the American market, set up an e-commerce operation, or create a holding structure for international investments, Wyoming provides a stable, secure, and highly efficient foundation.

Business Optimized

Team Members

Google Rating

Free consultation available

Wyoming consistently ranks among the top U.S. states for business formation due to its favorable tax regime, simple registration process, and commitment to privacy. Entrepreneurs can establish an LLC or corporation quickly, often in just a few days, and benefit from one of the lowest maintenance cost structures in the country.

Privacy is another major advantage. Wyoming does not require public disclosure of members or shareholders, ensuring that sensitive ownership details remain confidential. In addition, the state’s strong asset protection laws safeguard owners from personal liability, making Wyoming especially appealing to entrepreneurs and investors seeking security alongside growth potential.

By choosing Wyoming, you gain access to the credibility of the U.S. system while enjoying one of the most entrepreneur-friendly environments in the country.

Tailored setup packages for consultancy, trading, industrial, and e-commerce businesses.

Investor, partner, and employee residence visas with family sponsorship options.

Assistance with corporate bank account opening, ensuring smooth financial operations.

Choose from flexi-desks, furnished offices, warehouses, or industrial land.

Guidance with approvals, registrations, and government regulations.

Affordable packages for entrepreneurs selling products and services online.

Get expert guidance from our specialists and discover the best setup option for your business.

Even though Wyoming is widely recognized as one of the easiest states for incorporation, compliance with both state and federal rules remains essential. Every Wyoming company must maintain a registered agent within the state to handle official documents and correspondence. Annual reports are required to ensure that the company stays in good standing, although the cost is significantly lower than in other jurisdictions.

Federal obligations may apply depending on the nature of the business. For example, companies engaged in activities such as finance, insurance, or regulated industries must comply with U.S. federal licensing requirements. Maintaining accurate records and separating personal and business finances are also critical to preserving the benefits of Wyoming’s legal protections.

These requirements are not designed to create barriers but to ensure that Wyoming companies remain trusted, transparent, and compliant within the wider U.S. legal framework.

Tax efficiency is one of the primary reasons entrepreneurs choose Wyoming. Unlike many U.S. states, Wyoming imposes no corporate income tax and no personal income tax on its residents or companies. This makes it one of the most attractive jurisdictions in the United States for maximizing profits while minimizing state-level tax obligations.

Businesses in Wyoming are subject only to federal tax obligations where applicable, and depending on business activities, they may also need to register for sales tax. The overall cost of compliance is very low, with an annual state filing fee starting at only a modest amount. This simplicity and predictability make Wyoming a strategic choice for both domestic and international companies seeking to benefit from the U.S. market without excessive costs.

Most common is a Private Limited Company (Ltd).

Official legal documentation.

Register with the Tax Department.

Open a corporate account for financial operations.

Begin trading across the EU and globally.

Start your business setup today with our expert guidance. Free consultation available to discuss your specific requirements.

Banking is a critical part of establishing a Wyoming company, and the state offers access to a wide range of financial institutions. Entrepreneurs can open accounts with leading U.S. banks such as Chase, Wells Fargo, and Bank of America, as well as digital-first institutions offering modern multi-currency solutions.

Wyoming companies benefit from access to the U.S. dollar, one of the most trusted global currencies, and can easily manage international transactions. Online banking services provide secure and efficient platforms for businesses to manage finances from anywhere in the world. For e-commerce operators, consultants, and international investors, the ability to access reliable U.S. banking infrastructure is a key reason for choosing Wyoming as their incorporation base.

A Wyoming company is particularly suitable for entrepreneurs and investors seeking cost efficiency, privacy, and flexibility. It is an excellent option for:

– International entrepreneurs who want a trusted U.S. presence without relocating.

– E-commerce businesses that require U.S. banking and access to payment gateways.

– Startups and SMEs looking for a low-cost incorporation model.

– Investors establishing holding companies to manage global assets.

– Consultants, freelancers, and service providers seeking credibility and protection.

For businesses that value privacy, asset protection, and minimal bureaucracy, Wyoming remains one of the strongest choices in the United States.

Despite its many advantages, Wyoming is not suitable for every type of business. Companies that plan to raise significant venture capital may prefer Delaware, as it is the standard jurisdiction for U.S. startups attracting institutional investors. Similarly, firms requiring physical operations in major U.S. markets such as New York or California may be better served by incorporating in those states.

Wyoming also requires all companies to appoint a registered agent and file annual reports to remain compliant. While the requirements are straightforward and inexpensive, they are mandatory. Regulated industries such as banking, insurance, and healthcare must also comply with federal rules that go beyond the state-level framework.

These restrictions do not diminish Wyoming’s appeal but highlight the importance of selecting the right jurisdiction for your specific business objectives.

At Emifast, we make the process of establishing your Wyoming company seamless and stress-free. Our team provides end-to-end support, including:

– Preparing and filing incorporation documents with the Wyoming Secretary of State.

– Providing a registered office and professional registered agent services.

– Assisting with EIN applications and U.S. tax registrations where required.

– Supporting the opening of U.S. and international bank accounts.

– Offering ongoing compliance and advisory services to keep your company in good standing.

By partnering with Emifast, you ensure that your Wyoming entity is not only incorporated correctly but also structured for long-term growth, compliance, and profitability.

Get answers to the most frequently asked questions about business setup and our services.

No, Wyoming does not levy corporate or personal income tax. Only federal tax obligations may apply, depending on business activity.

Yes, Wyoming allows full foreign ownership of companies without requiring residency. A registered agent is required.

In most cases, incorporation can be completed within a few business days once all documents are prepared.

Wyoming offers strong asset protection, privacy, and minimal costs, making it ideal for managing global investments.

The right choice for businesses that want total freedom and growth potential. With Emifast, the process is managed from start to finish, ensuring your license is issued smoothly and your business is ready for operations.

Instant response via WhatsApp

info@emifast.com

+971 58 584 4519

Emifast Headquarters

Dubai South, UAE

Fill out the form below and our expert will contact you within 24 hours.

I consent to Emifast collecting my detail: name, phone number, email for contacting me. I agree with emifast’s Terms and Condition and privacy policy by submitting the form