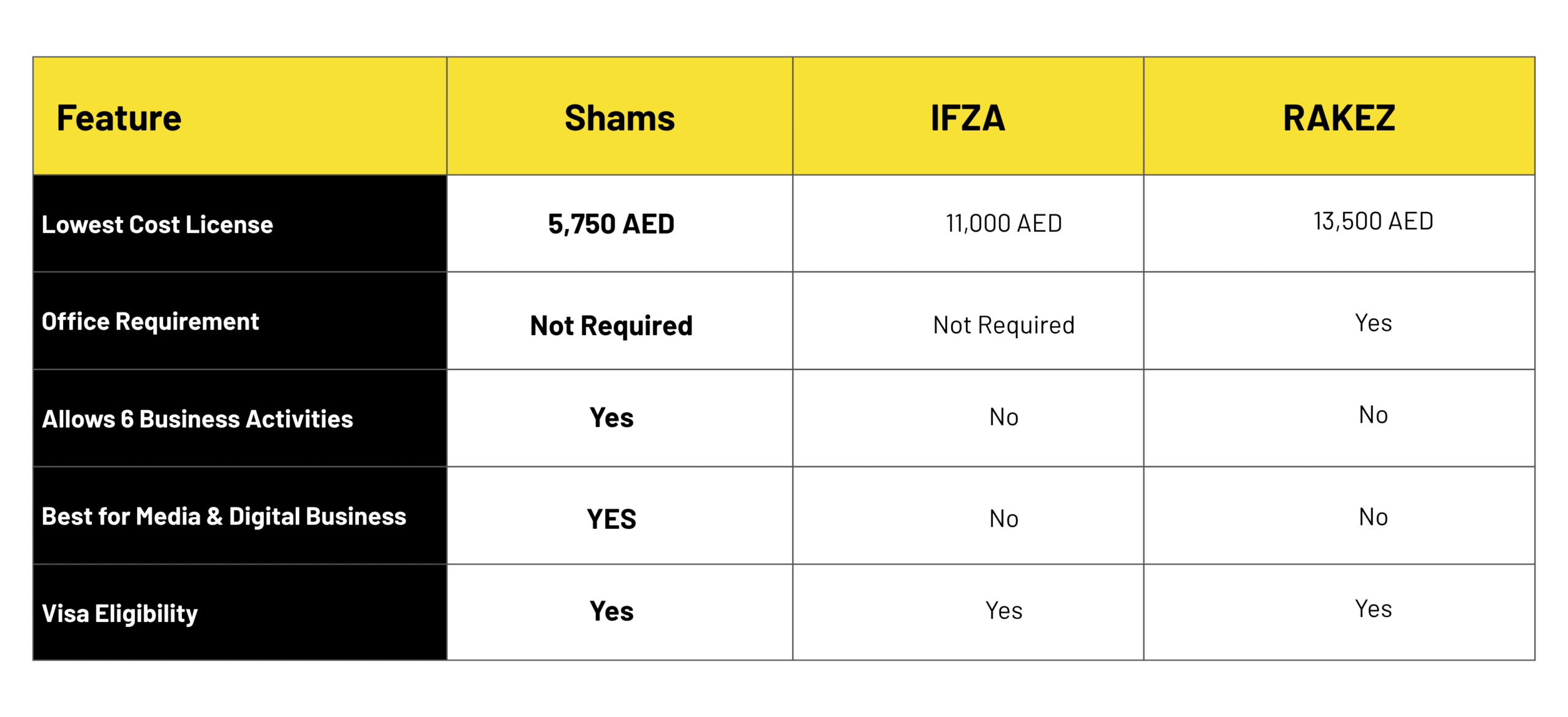

1-year license, 1 visa

1-year license, 1 visa

1-year license, 2 visas

1-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

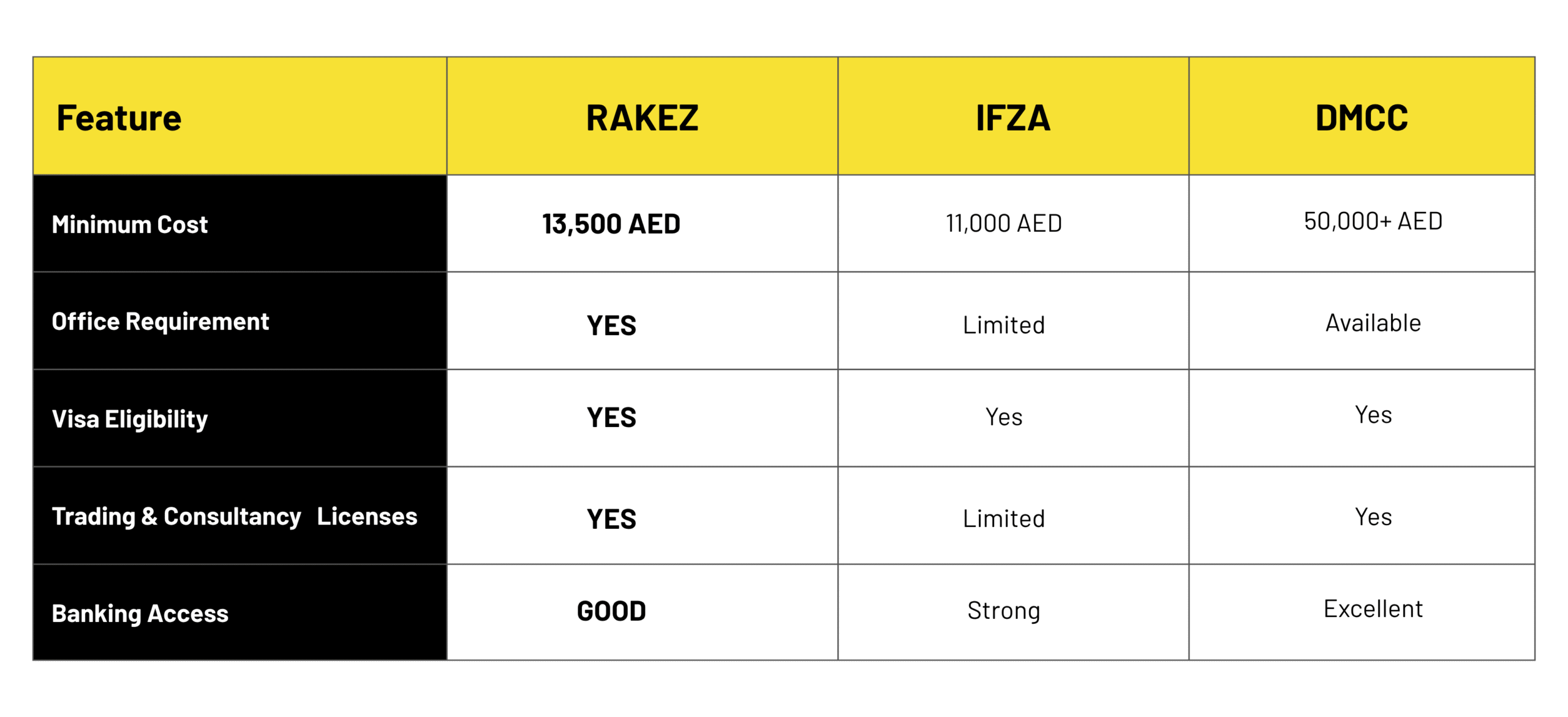

1-year license, No visa

1-year license, 1 visa

1-year license, 1 visa

3-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

Choosing the right free zone depends on your industry, business model, and expansion plans. Contact us for a personalized consultation.

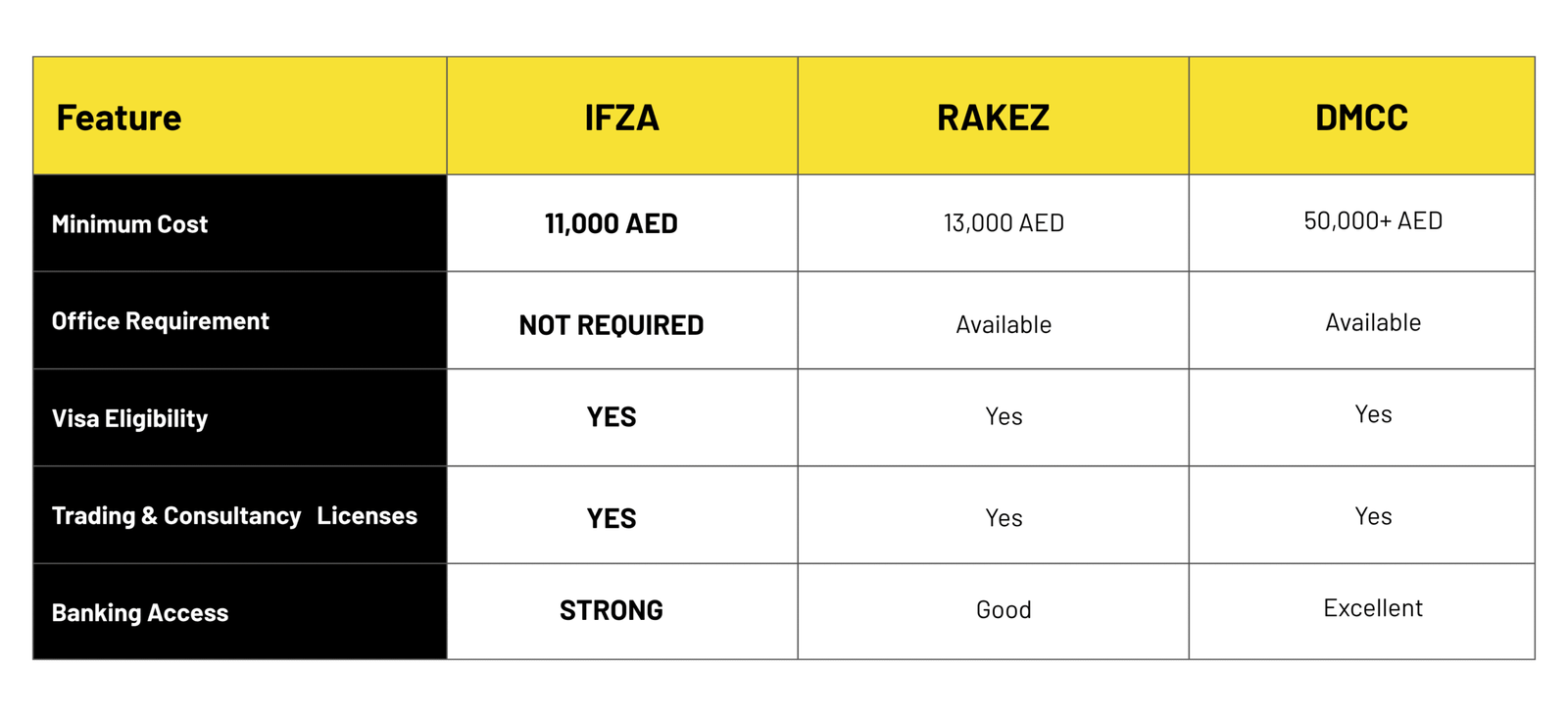

1-year license, No visa

1-year license, 1 visa

1-year license, 1 visa

3-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

Choosing the right free zone depends on your industry, business model, and expansion plans. Contact us for a personalized consultation.

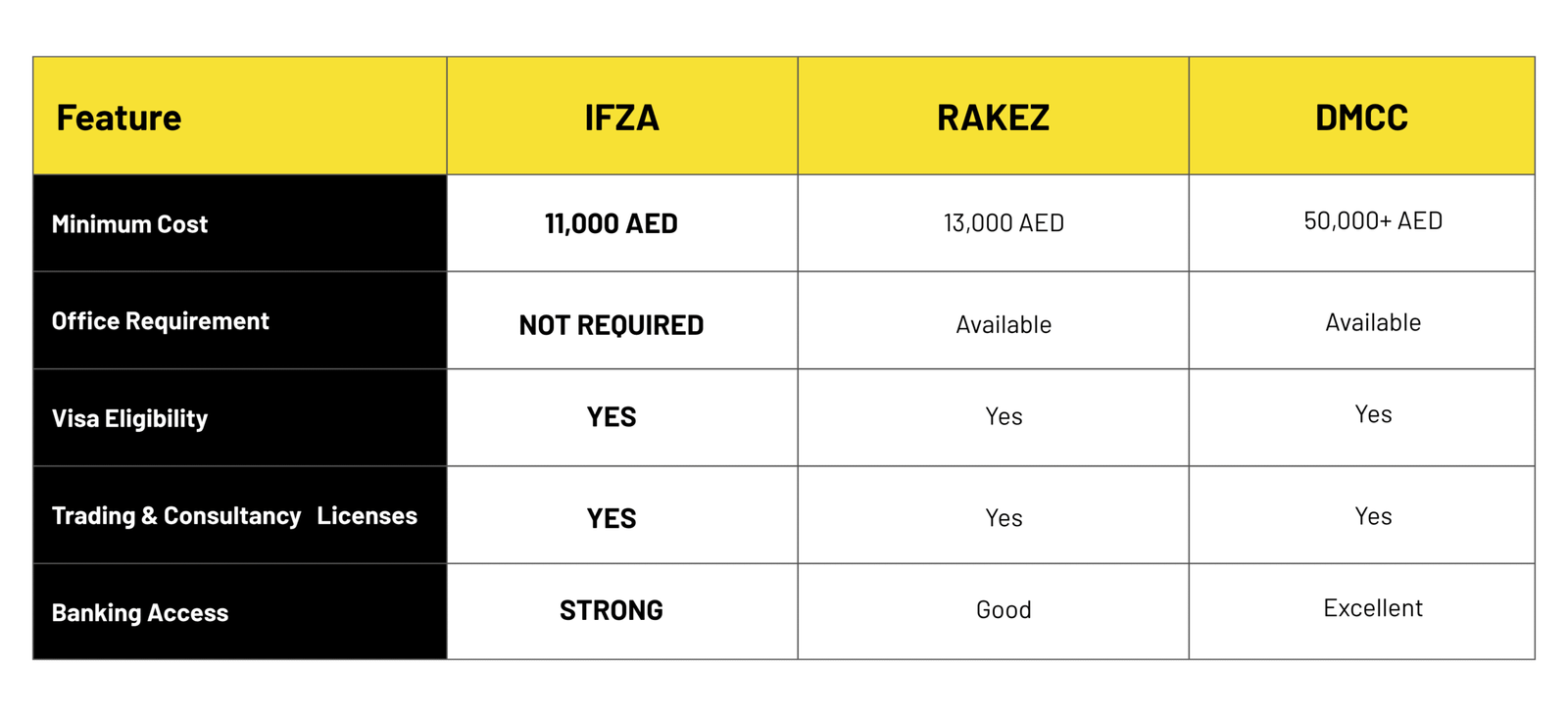

1-year license, No visa

1-year license, 1 visa

1-year license, 1 visa

3-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

1-year license, No visa

1-year license, 1 visa

1-year license, 1 visa

3-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

1-year license, No visa

1-year license, 1 visa

1-year license, 1 visa

3-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

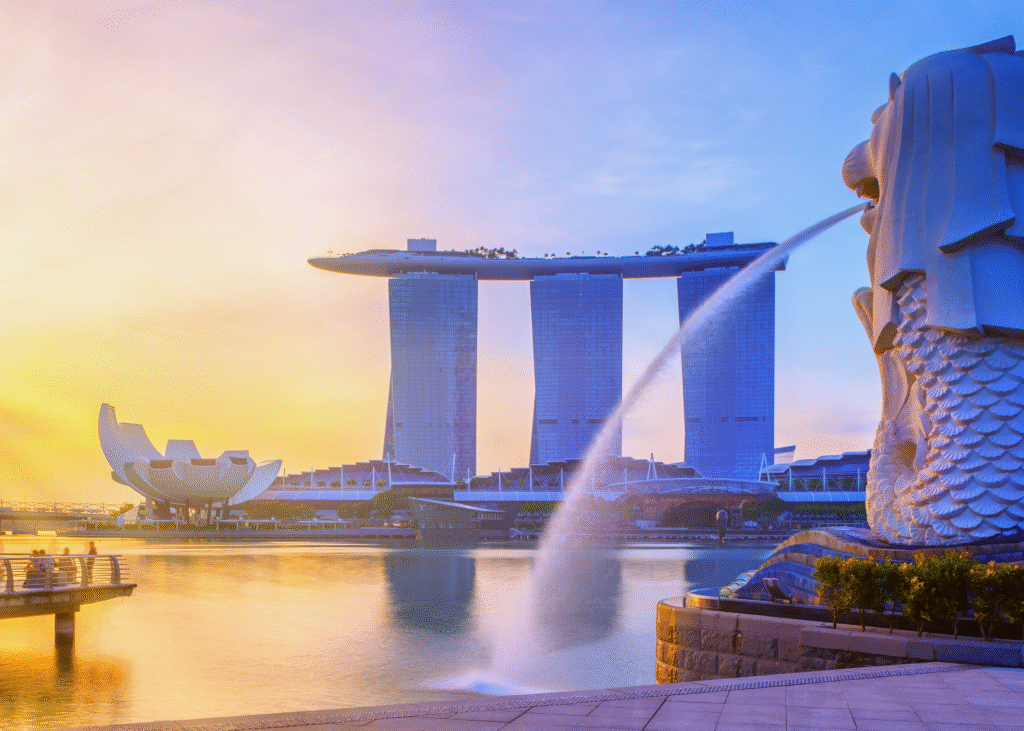

Singapore is one of the world’s most competitive economies and a global hub for trade, innovation, and finance. Known for its strategic location, investor-friendly regulations, and advanced infrastructure, the city-state attracts thousands of international businesses each year. Entrepreneurs benefit from straightforward incorporation procedures, attractive tax incentives, and access to world-class financial and banking systems.

Whether you are a startup founder, multinational enterprise, or investor, Singapore provides the credibility, security, and connectivity to grow your business across Asia and beyond.

Business Optimized

Team Members

Google Rating

Free consultation available

Singapore consistently ranks as one of the easiest places in the world to do business. It offers entrepreneurs access to Southeast Asia’s fast-growing economies while maintaining one of the world’s most transparent regulatory systems. Businesses benefit from low corporate taxes, a highly educated workforce, and advanced infrastructure across logistics, technology, and finance.

The city-state’s strategic location makes it a natural gateway between Asia, Europe, and the Middle East. With strong intellectual property protections, reliable courts, and a pro-business government, Singapore is the destination of choice for entrepreneurs seeking stability and growth.

Tailored setup packages for consultancy, trading, industrial, and e-commerce businesses.

Investor, partner, and employee residence visas with family sponsorship options.

Assistance with corporate bank account opening, ensuring smooth financial operations.

Choose from flexi-desks, furnished offices, warehouses, or industrial land.

Guidance with approvals, registrations, and government regulations.

Affordable packages for entrepreneurs selling products and services online.

Get expert guidance from our specialists and discover the best setup option for your business.

Singapore is internationally recognized for its competitive and transparent tax policies. Corporate tax rates are capped at 17%, with exemptions and incentives for startups, R&D-intensive companies, and industries considered vital to economic growth. Dividends are tax-free, and there are no capital gains taxes, making it one of the most attractive environments for global investors.

The banking sector is equally advanced, offering businesses secure multi-currency accounts, efficient cross-border transfer systems, and digital tools that support international operations. Companies benefit from reliable financial institutions, many of which are globally ranked, ensuring trust and accessibility.

Setting up a company in Singapore begins with selecting the right structure, with a Private Limited Company usually offering the best balance of flexibility and liability protection. The company name is then reserved with ACRA, while we prepare all supporting documents including the shareholder register, constitution, and KYC information to ensure a smooth filing process. At least one resident director must be appointed, and a registered local address secured; the company secretary can be designated at the same stage to meet compliance requirements from day one. Once approved, we open a multi-currency bank account, apply for your tax identification with the Inland Revenue Authority of Singapore (IRAS), and handle GST registration immediately or once your turnover meets the threshold. With complete documentation, incorporation is typically finalized within 5–7 business days, allowing you to start operations and sign contracts almost immediately. Every step is closely monitored to ensure the process is seamless, compliant, and free from delays.

Most common is a Private Limited Company (Ltd).

Official legal documentation.

Register with the Tax Department.

Open a corporate account for financial operations.

Begin trading across the EU and globally.

Start your business setup today with our expert guidance. Free consultation available to discuss your specific requirements.

Singapore is ideal for entrepreneurs who want a credible Asian hub with access to fast-growing regional markets and strong legal protections. Technology and fintech scale-ups benefit from a mature talent pool, advanced IP laws, and investors who are familiar with Singapore structures. E-commerce, logistics, and trading companies thrive on Singapore’s world-class connectivity, both in air and sea freight, while its strategic location ensures efficient access to international supply chains. Professional services firms such as consulting, legal, and financial companies gain trust and stability from a predictable regulatory framework. Multinational corporations often choose Singapore for their regional headquarters, appreciating the transparent tax system, reliable banking sector, and supportive government policies. For anyone seeking to combine growth, credibility, and international reputation, Singapore provides a complete solution.

While Singapore offers many advantages, some businesses may prefer other jurisdictions. Companies requiring ultra-low operating costs or large-scale manufacturing bases may find better options in other Asian markets. Additionally, businesses seeking EU access directly may prioritize European jurisdictions over Singapore.

At Emifast, we align your long-term goals with the right jurisdiction, ensuring you select the market that best supports your strategic growth.

With its strong economy, modern infrastructure, and investor-friendly ecosystem, Singapore provides one of the best platforms in the world for business expansion. Whether you are entering Asia for the first time or looking to relocate your headquarters, Singapore ensures both growth and credibility.

Partner with Emifast to simplify incorporation, banking, and compliance, so you can focus on scaling your business.

At Emifast, we streamline the entire business incorporation process in Singapore. From company structuring to document preparation, banking setup, and compliance advisory, we manage every step efficiently. We also provide ongoing support for tax filings, regulatory updates, and regional expansion strategies.

By working with Emifast, you gain a trusted partner who ensures your setup is smooth, compliant, and tailored to your long-term objectives.

Get answers to the most frequently asked questions about business setup and our services.

Yes, foreigners can fully own companies in Singapore without requiring local shareholders.

Most incorporations are completed in 5–7 working days, provided all documents are in order.

Corporate tax is capped at 17%, with exemptions and incentives for startups and specific industries.

At least one director must be a Singapore resident, but foreign investors can incorporate with the right local support

The right choice for businesses that want total freedom and growth potential. With Emifast, the process is managed from start to finish, ensuring your license is issued smoothly and your business is ready for operations.

Instant response via WhatsApp

info@emifast.com

+971 58 584 4519

Emifast Headquarters

Dubai South, UAE

Fill out the form below and our expert will contact you within 24 hours.

I consent to Emifast collecting my detail: name, phone number, email for contacting me. I agree with emifast’s Terms and Condition and privacy policy by submitting the form