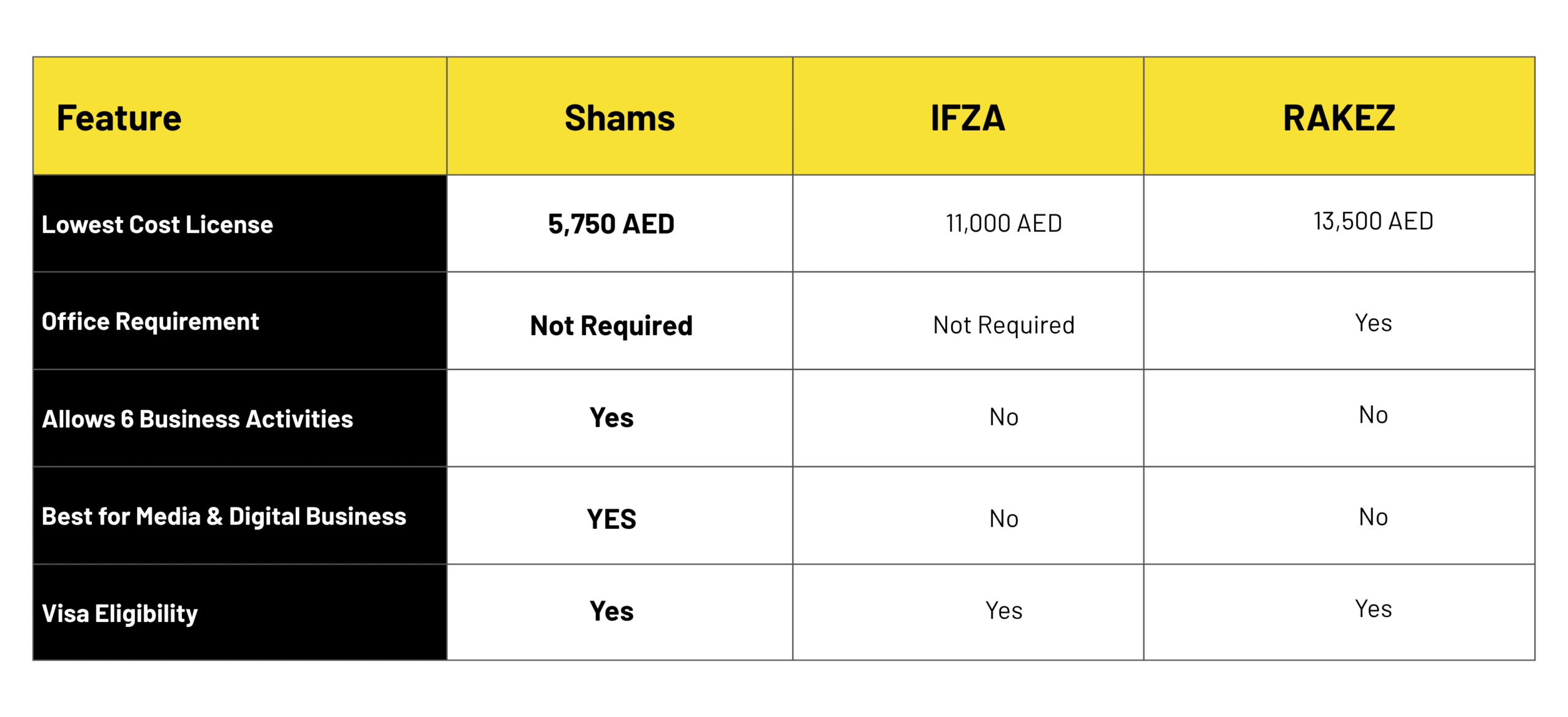

1-year license, 1 visa

1-year license, 1 visa

1-year license, 2 visas

1-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

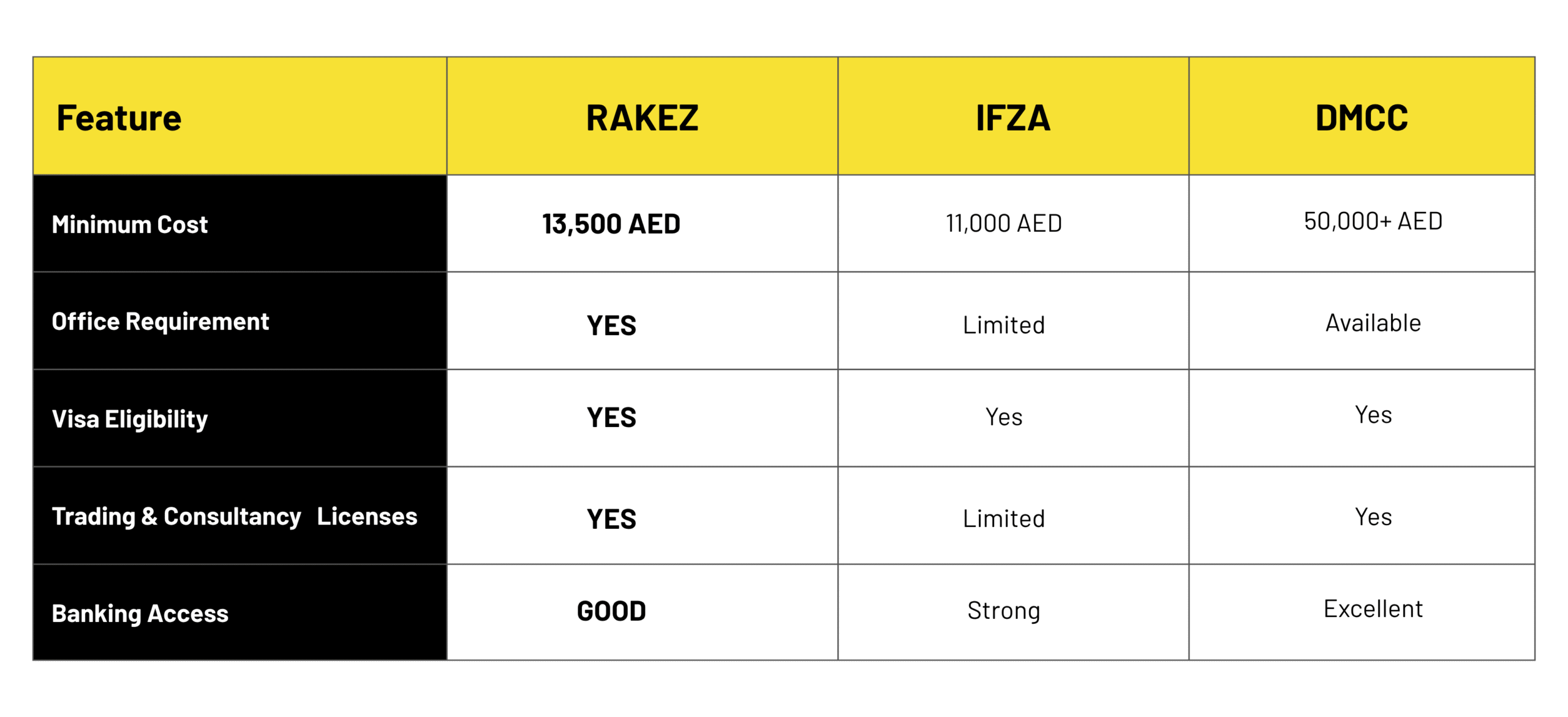

1-year license, No visa

1-year license, 1 visa

1-year license, 1 visa

3-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

Choosing the right free zone depends on your industry, business model, and expansion plans. Contact us for a personalized consultation.

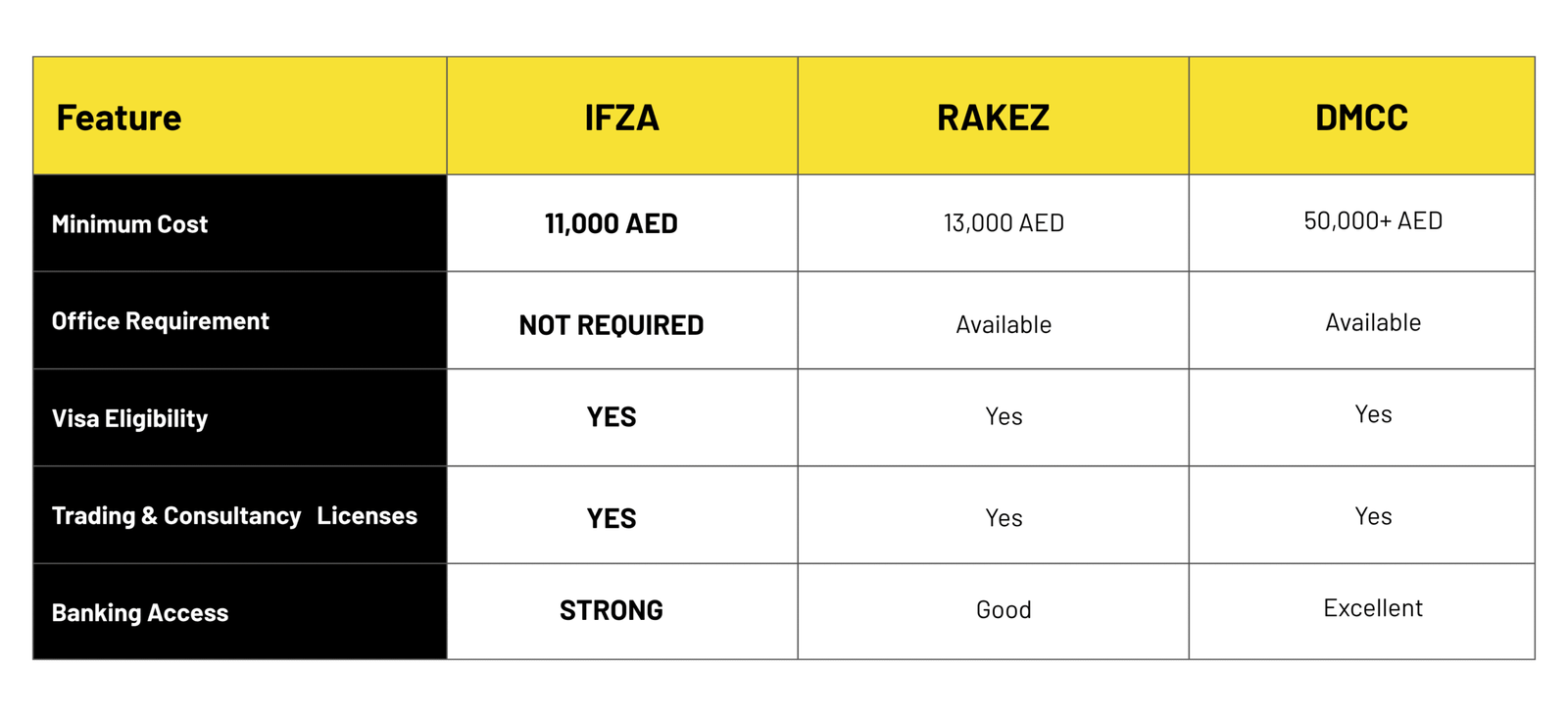

1-year license, No visa

1-year license, 1 visa

1-year license, 1 visa

3-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

Choosing the right free zone depends on your industry, business model, and expansion plans. Contact us for a personalized consultation.

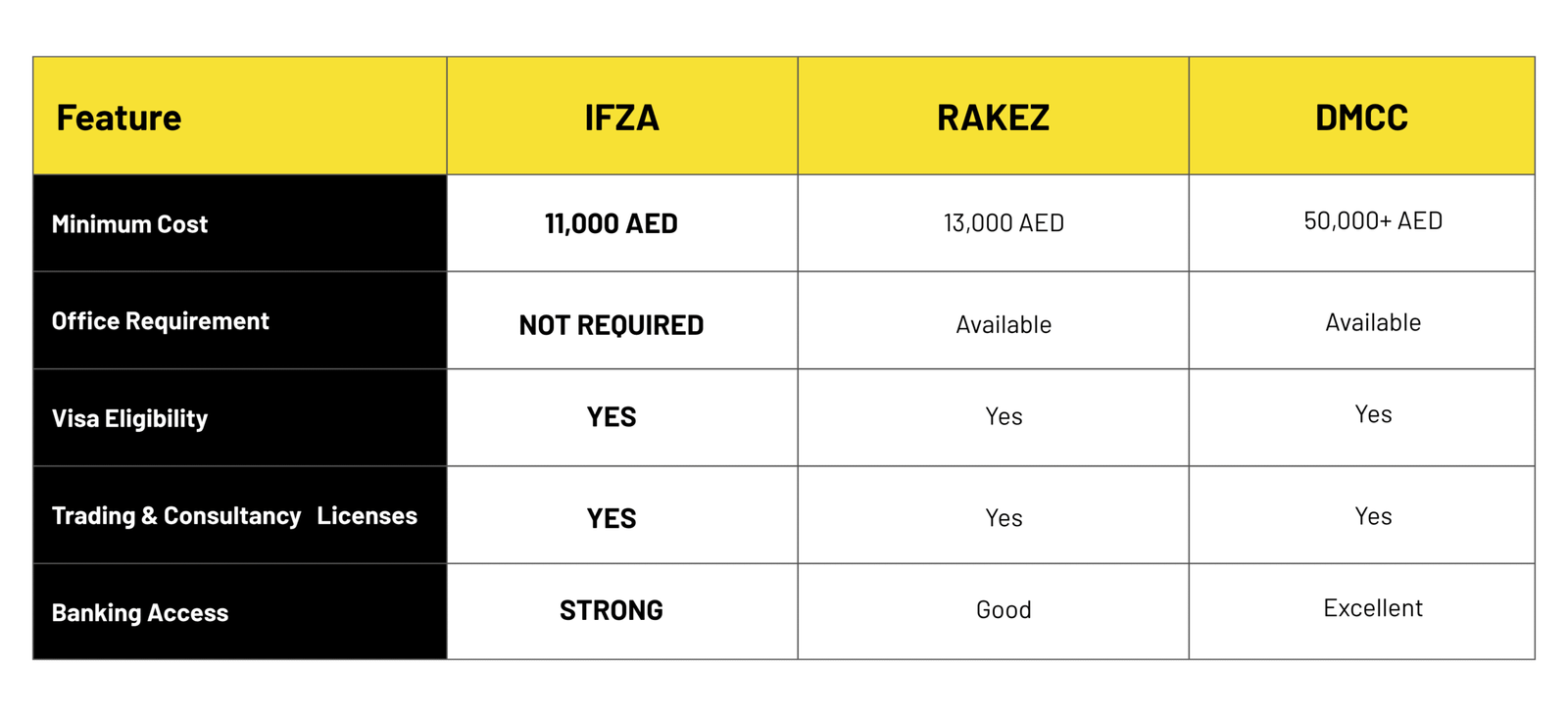

1-year license, No visa

1-year license, 1 visa

1-year license, 1 visa

3-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

1-year license, No visa

1-year license, 1 visa

1-year license, 1 visa

3-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

1-year license, No visa

1-year license, 1 visa

1-year license, 1 visa

3-year license, 2 visas

Note: Prices may vary depending on business activity and additional services required.

Cyprus is an increasingly popular jurisdiction for global entrepreneurs who want to combine low corporate taxation with full European Union access. The island offers a unique balance between affordability, credibility, and international reach, making it a leading choice for holding structures, trading companies, and startups. With reforms aimed at attracting foreign investors and a strong financial services ecosystem, Cyprus is considered one of the safest and most profitable destinations in Europe for business setup.

At Emifast, we handle the entire process for you — from selecting the right license and company structure to managing banking, tax, and compliance. Our team ensures that your business is not only launched smoothly but also positioned for long-term growth within the EU and global markets.

Business Optimized

Team Members

Google Rating

Free consultation available

Cyprus is more than just a low-tax jurisdiction; it is a strategic hub that links Europe, the Middle East, and Africa. As a full member of the EU, businesses incorporated in Cyprus enjoy seamless access to all European markets while benefiting from international credibility and financial stability. This makes it an ideal base for entrepreneurs who want to expand regionally while maintaining global reach.

The island also boasts a stable political system and a legal framework based on English common law, offering clarity and security for investors. With more than 65 double taxation treaties in place, Cyprus provides significant tax advantages for international operations. Beyond business, Cyprus is known for its high living standards, modern infrastructure, and a skilled workforce that supports sectors like finance, IT, and logistics.

By combining credibility, cost-efficiency, and connectivity, Cyprus is one of the best destinations for both small startups and multinational corporations. Whether your goal is tax optimization, European market entry, or international trade, Cyprus delivers a highly competitive environment.

Tailored setup packages for consultancy, trading, industrial, and e-commerce businesses.

Investor, partner, and employee residence visas with family sponsorship options.

Assistance with corporate bank account opening, ensuring smooth financial operations.

Choose from flexi-desks, furnished offices, warehouses, or industrial land.

Guidance with approvals, registrations, and government regulations.

Affordable packages for entrepreneurs selling products and services online.

Get expert guidance from our KSA specialists and discover the best setup option for your business.

One of the strongest reasons companies choose Cyprus is its transparent and competitive tax system. Corporate tax is set at just 12.5%, making it one of the lowest rates in Europe. In addition, dividend income may be exempt from tax under certain conditions, and there are no withholding taxes on dividend or profit repatriation. This gives businesses the flexibility to expand globally without unnecessary financial burdens.

Banking in Cyprus is equally attractive, with a modern and EU-regulated system that ensures safety and efficiency. Local and international banks offer multi-currency accounts, digital banking solutions, and easy access to credit facilities. For companies engaged in cross-border trade or holding structures, this provides a seamless way to manage global transactions.

Furthermore, Cyprus maintains double taxation agreements with 65+ countries, reducing exposure to international tax risks. The simplicity of its banking and taxation system is a major reason why thousands of international investors have already chosen Cyprus as their corporate base.

Setting up a company in Cyprus is efficient, but it requires a clear understanding of the legal process. With Emifast, you are guided through every step to ensure compliance and avoid unnecessary delays.

Most common is a Private Limited Company (Ltd).

Official legal documentation.

Register with the Cyprus Tax Department.

Open a corporate account for financial operations.

Begin trading across the EU and globally.

Start your business setup today with our expert guidance. Free consultation available to discuss your specific requirements.

Cyprus is especially well-suited for companies that want to maximize both tax efficiency and market access. International entrepreneurs looking for a secure EU base with affordable costs will find Cyprus to be an excellent choice.

Holding companies benefit from tax exemptions on dividends, while trading and logistics firms profit from the island’s unique geographic position. IT, consulting, and professional services companies also thrive here thanks to a highly skilled workforce and international reputation.

Cyprus is also attractive for entrepreneurs seeking EU residency options through business setup, as its residency program is straightforward and investor-friendly. With low taxes, international recognition, and access to the European market, Cyprus is a top choice for ambitious business owners.

Cyprus offers an attractive path for entrepreneurs and investors who want to establish tax residency while enjoying EU-level benefits. Residency can be obtained through flexible requirements, making Cyprus one of the most accessible countries for international investors.

Tax residents benefit from exemptions on dividend income, interest income, and capital gains from securities. With only 60 days of minimum residency per year, entrepreneurs can maintain residency while still managing global operations.

This makes Cyprus a leading destination for investors seeking both personal tax advantages and a safe European residence. The combination of low tax rates, EU membership, and residency options makes Cyprus a powerful jurisdiction for global entrepreneurs.

While Cyprus is highly attractive, it may not be ideal for all types of businesses. For companies that need ultra-low setup costs or immediate Gulf market access, jurisdictions like the UAE may be more suitable.

Similarly, businesses in industries that demand heavy manufacturing or large-scale workforce availability may prefer Eastern European or Middle Eastern markets. Emifast helps clients assess their goals and compare different jurisdictions before making a final decision.

Get answers to the most frequently asked questions about Cyprus business setup and our services.

12.5%, one of the lowest in the EU.

Yes, 100% foreign ownership is fully permitted.

Typically 1–2 weeks with complete documentation.

Yes, with more than 65 countries worldwide.

Absolutely, Cyprus is one of the most preferred EU jurisdictions for international holding structures.

Cyprus is the right choice for businesses that want total freedom and growth potential in the Cyprus. With Emifast, the process is managed from start to finish, ensuring your license is issued smoothly and your business is ready for operations.

Instant response via WhatsApp

info@emifast.com

+971 58 584 4519

Emifast Headquarters

Dubai South, UAE

Fill out the form below and our expert will contact you within 24 hours.

I consent to Emifast collecting my detail: name, phone number, email for contacting me. I agree with emifast’s Terms and Condition and privacy policy by submitting the form